I last visited the village of Zaboka in March 2013. That was nine months after we celebrated graduation for the CLM families in Tit Montay, the mountainous region of northwestern Boucan Carré that includes Zaboka. It is hard to get to. No paths that even a motorcycle can manage reach anywhere within a long hike. Since that visit, I had tried to arrange some time to hike up on a couple of occasions, but it had never worked out.

So I was wondering what I’d find as I headed towards the waterfall that divides eastern Tit Montay from Central Boucan Carré on Christmas Eve’s Day. I had left CLM headquarters in Mirebalais the morning, and I had taken my time, so it was midafternoon by the time I got to the old CLM base in Zaboka, at Nava’s house. Nava was off in western Tit Montay, visiting a sick farmer. He is the closest thing to a doctor within a long hike of Zaboka. He’s been a Partners in Health community health worker for a long time, and is a learned practitioner of traditional rural healing arts.

But his wife and Fona, one of his sons, were at home. Madan Nava put water for coffee on the fire, and started planning an evening meal for her unexpected guest. Fona made ready the room that the CLM team had rented for almost two years. It had become his since we left, but it would be mine for the next few days.

The CLM team does not have any organized way to follow the lives of our graduates after they leave the program. After eighteen months with the families, we have to move on. Some members enter Fonkoze’s credit programs, but then they are more connected to our commercial partner, Fonkoze Financial Services and its credit staff, than to the CLM team. We are always happy to come across such as we bump into now and again, because they almost always confirm our belief that the improvements they’ve made in their lives are lasting. Even those we find who have slipped back into hard financial difficulties generally show an understanding of the possibilities before them and an optimism which has its roots in their ability to plan a return to better times. So I was looking forward to the chance to see some remote members more than three years after graduation.

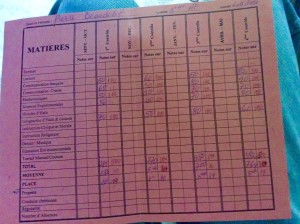

A place like Zaboka is especially interesting to us. Programs like CLM are generally called “graduation programs.” The idea is that the participants need very intense accompaniment to overcome the extreme poverty they face, but that even after they complete our program, they’ll be well served to continue in other programs that an institution like Fonkoze can offer. They “graduate” from one kind of accompaniment to another. In Fonkoze, a series of differently designed programs make up what we call the “staircase out of poverty,” with CLM as the first step. Typically we have encouraged members to join Fonkoze’s credit programs after they finish with us. It gives them a good way to continue their progress after we’ve helped them start.

But Fonkoze Financial Services has struggled to provide credit in especially remote areas like Zaboka. It hasn’t worked well, and it isn’t clear whether it can work at a cost that’s sustainable. So the former CLM members there had been on their own since we’d left them. Seeing them continue to prosper would encourage us greatly.

On Christmas day, I went on a long hike. I would visit Chipen, in north central Tit Montay, a two-hour hike up from our base. Then I would climb up to the top of Do Zoranj, the ridge that separates Tit Montay from Hinche and Maïssade, to the north. That would allow me to cross over to Bwawouj. From there, I’d descend the rocky, twisting path back to Zaboka. I’d be back by late afternoon if I left early enough and be ready to return to Mirebalais the next day.

Edithe

When I got to Chipen, I went straight to Edithe’s house. I had seen her on my last trip, and she had been doing well. Her children were healthy, and all but the oldest girl had been in school. Before she joined CLM she hadn’t been able to send any of them. She told me about her livestock – she had suffered some losses, but they had increased on the whole – and about her future plans.

I again found Edithe at home. The last time I had come it would have been more accurate to say that she found me, running up when she saw me starting up the slope after I had crossed the mountain stream that separates Chipen from Labòd. But this time, she didn’t see me until I turned into her yard. She was doing chores together with her kids.

Her oldest girl was visiting. In the years since my last visit, she had married a young man from the other side of Do Zoranj, near the market in Nan Sab. Edithe was happy about the marriage. She both liked and trusted her son-in-law. Her goats and her cow had gotten healthier since he began to care for them for her. There is more and better forage around Nan Sab than Chipen. Her cow had had a calf, and both were doing well, as were her goats.

She did talk about one problem: Her children weren’t in school anymore. It wasn’t that she was unwilling or unable to send them. The problem was that there was no school. The one nearby in Labòd had closed. This happens often enough in areas where too few parents can pay enough to enable a school’s owner to keep the teachers paid. Edithe had tried hiring a teacher to give her children private lessons, but he had taken her money and left the area after a month. She wasn’t sure yet what she would do. The nearest functioning schools were farther than the smaller children could walk every day.

When it was time for me to move on, she told her children that she’d be going off for a while and that they should see to finishing their chores. She wanted to lead me most of the way to Bwawouj. They way I had planned to take was much too long. There was a shorter route, but she’d have a hard time explaining it to me. She’d rather just lead me along.

It was a straight uphill hike. Her house in Chipen is about 3200 feet high, but Do Zoranj is at over 5500 feet. The route she chose was much shorter than the one I knew, but much steeper, too. When we got to the ridge, she sent me on my way, asking when I’d see her again. I told her I didn’t know, but that I would just appear sometime. “Just like I did today.” She smiled and headed back to her kids.

I followed the path along Do Zoranj to Bwawouj. I was especially anxious to see Mirlène and Orelès, a young couple who lived at the top of the ridge,m with a view of Regalis over 3000 feet below..

Orelès, Marlène, and their boy

While the family was in the program, Mirlène had given birth to their second child. Then both she and the child had grown sick. The couple believed it was because Orelès had been unable to pay their midwife’s bill. Though Mirlène eventually recovered, they lost the child shortly before Mirlène graduated. And the day I first met Orelès was when he came down to Domon so that I could give him some money out of our CLM emergency fund to offset the cost of the funeral. It was a way for us to help them protect the assets they’d begun to accumulate.

When I saw them in 2013, things had reversed. Mirlène was taking care of Orelès, who had spent more than two weeks too sick even to get out of bed. They had sent their older daughter to Mirlène’s mother so that Mirlène could focus on giving her husband the care he needed.

They were getting by. Orelès’s brother and sister-in-law were helping them out. But Orelès seemed afraid. They had been on my mind frequently in the interval, but it is so hard to get to Bwawouj that I could never learn how things had turned out.

I walked past their house as I looked down towards the rest of Bwawouj. It turns out that I didn’t remember exactly which house was theirs. But Mirlène saw me and yelled. Even from a distance, she was pretty sure she knew it was me. As I walked back into their front yard from behind the house she greeted me with a big smile and a respectful peck on the cheek. Orelès strolled in from their field almost immediately after that. I didn’t even have to ask the biggest question on my mind. He was clearly in the very best of health.

He’s a thin slip of a man, especially compared to his powerfully built wife. But he’s a farmer in a non-mechanized culture, who has spent his life hiking up to his home at the top of a 5500-foot hill. So when things are right, you can see that he’s healthy and strong. Like Mirlène, he was smiling broadly. He slipped inside their small house, and brought a couple of plates of tchaka – a hearty stew of beans and whole kernels of corn. He asked whether I could eat peasant food, and smiled as I took a plate. We began to chat as we ate.

Mirlène went inside too, but she fetched their little boy, whom she wanted me to see. He wasn’t yet a year old. He had been born some time after Orlelès regain his health. And the boy looked great. As she held him in her lap, she told me that they had taken her oldest girl back from her mother, too. The family was together again.

Orelès added some explanation. They were doing well, and he was in a mood almost to boast. Thanks to his mother-in-law, his brother, and his brother’s wife, they had made it through his sickness without selling off the livestock that we gave them. He had then been able to go back to his farming, and his crops had been good, especially the beans. He had been able to add a cow to the animals they already owned, and they had purchased some additional farmland as well.

I couldn’t stay long. So we said our goodbyes. But I had plenty to feel encouraged about as a headed down the winding, treacherously rocky path back from Bwawouj to Zaboka and to Nava’s house.

There was one more person I wanted to talk to when I got back to Zaboka. Ytelet didn’t live there anymore. She had moved to Regalis. But I was lucky. She had come back for a couple of days to see her parents and attend a wedding.

Ytelet

Early in her experience with us, Ytelet and her younger brother, Dieulonet, had been near to death. They hadn’t had much but high fevers complicated by malnutrition, but their family had given up on them. They wouldn’t bother to carry them down to the hospital in Central Boucan Carré because local healers had told the family that there was no use. Ytelet’s case manager, Martinière, had his own opinion, and he mobilized some assistance to get them down to the hospital, where they received the care they needed. They had recovered, more or less, within a week.

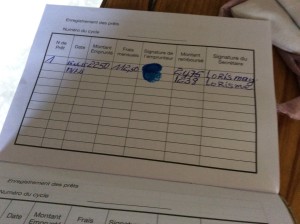

Ytelet and Martinière then got to work developing a way for Ytelet to earn an income. Her children’s father had a wife and more kids on the other side of Tit Montay, so he wasn’t doing much for them. Ytelet had been farming land as a sharecropper, using seeds that she would borrow, paying back in kind with interest at 100%. It was what she knew how to do, but it was also a cycle of poverty that appeared to have no escape.

But Martinière showed her how to start a small business in beans with cash that we gave her, and she eventually earned enough to both rent farmland and provide her own seeds. It was a business model that worked. The net return on her first harvest was nearly ten times what her return on her last sharecropped land had been.

She continued both her year-round bean business and her seasonal farming, and her modest wealth grew. She purchased additional livestock, including a cow, and was eventually able to send her children to a school down in Central Boucan Carré, one much better than anything they could attend in Zaboka.

I had been looking for her in Central Boucan Carré since the start of the school year, but had never come across her. As we talked in Zaboka, I learned why.

Her children’s father had cheated her. He had agreed to take care of her cow. Her bean business took her away so much that she couldn’t do it herself. But he had sold the cow without telling her and taken the money himself.

She didn’t want to take him to court. He is her children’s father. But she didn’t want to have anything more to do with him, either. So she dumped him. She knew she could do very well without him.

But a young, healthy, and successful woman certainly wouldn’t lack suitors, and Ytelet had plenty of them almost right away. She decided to get together with a successful farmer from Regalis. She saw her children liked the man, and he seemed to like her kids as well. He was willing to take her with the three of them, and promised to send them to school at his own expense. So she moved to Regalis. It was a good move for business, too. The Regalis market is a good place to buy and sell beans.

Now she hikes back and forth between Zaboka and Regalis to work her farmland in Zaboka and buy beans from local farmers. And she has a plan. She is saving up to buy a mule. Owning one will help her take her business to another level because she’ll be able to take beans to sell at the larger markets down in towns like Thomonde and Hinche, where the prices are higher.

The CLM team worked with 109 families in and around Zaboka, and with over 360 across all of Tit Montay. Talking to three of them isn’t enough to draw any conclusions. But their work and the work of their case managers seems to have enabled them to succeed on their own.